Before Fibre, there was copper!

It’s almost difficult to believe that not so very long ago (ok, going back maybe more than 50 years) there were no optical fibre or digital transmission paths of any flavour of technology providing our communications infrastructure.

Analogue FDM

From early to mid 20th Century, an extensive core copper cable network was rolled out, based on analogue FDM (frequency Division Multiplexing) over coaxial pairs, with the valve-based technologies occupying a lot of space and consuming much power.

Digital PCM

The late 1960s saw the introduction of digital PCM (Pulse Code Modulation) sampling at 8kHz. The ITU-T (International Telecommunication Union – then known as CCITT) standardised 30-channels at 64kbit/s in a 2.048Mbit/s multiplexing system, using 8-bit A-law algorithm (the USA adopted 24-channel 1.544Mbit/s with μ-law algorithm).

Problems with high bit-rates

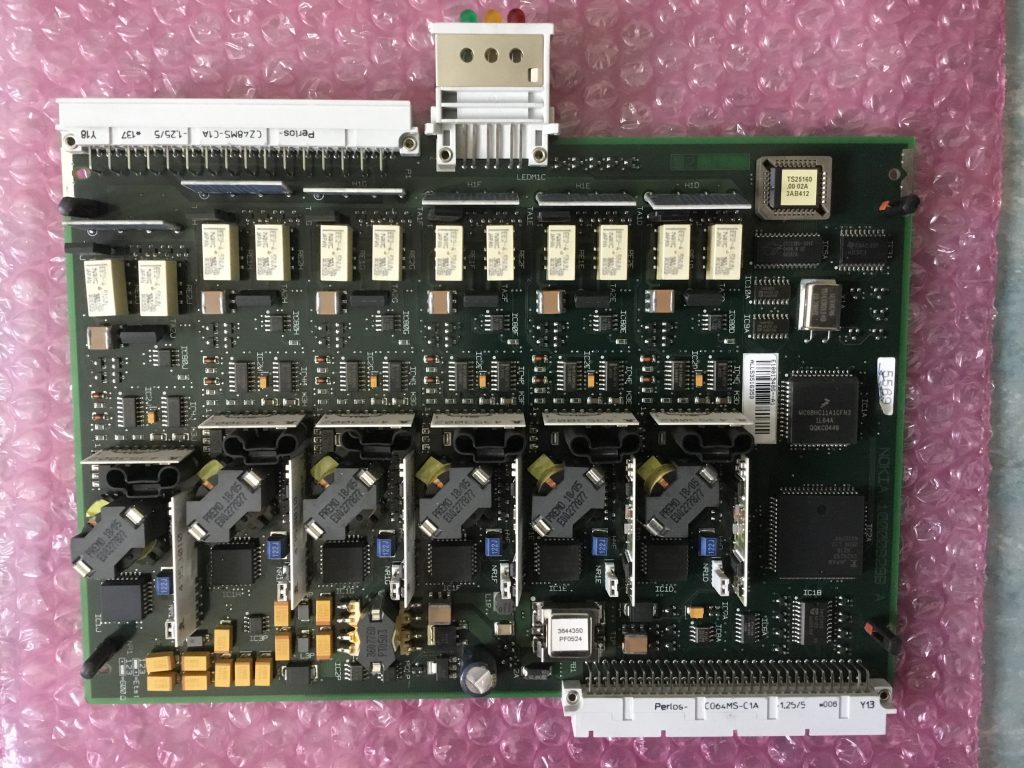

The higher bit rates gave rise to crosstalk interference problems on many existing cables. Also, data signals transmitted as voltage levels in unipolar NRZ (Non-Return to Zero) format are not self clocking and have a significant DC component, wasting power. Bipolar RZ (Return-to-Zero) type AMI (Alternate Mark Inversion) coding prevents the build up of the DC-component for longer distance and addresses the issue of data containing multiple ones. However, long sequences of zeros still present problems with a lack of transitions causing difficulties maintaining synchronisation.

Introduction of Line Codes

Line Coding of the format mB-nB was introduced to overcome these issues. Initially 4B3T (four Binary, three Ternary) was used. This encodes each 4-bit input group into a 3 symbol output using the three states of positive, negative and no pulses.

e.g. ‘0000’ is coded as ‘+0-‘

This improved efficiency in terms of bit per symbol over AMI, which itself is an example of a 1B1T code. Improvements in transverse screened cables were also made. However, transmission problems with high-speed digital data were still encountered due to unsuitable copper cabling which needed to be addressed.

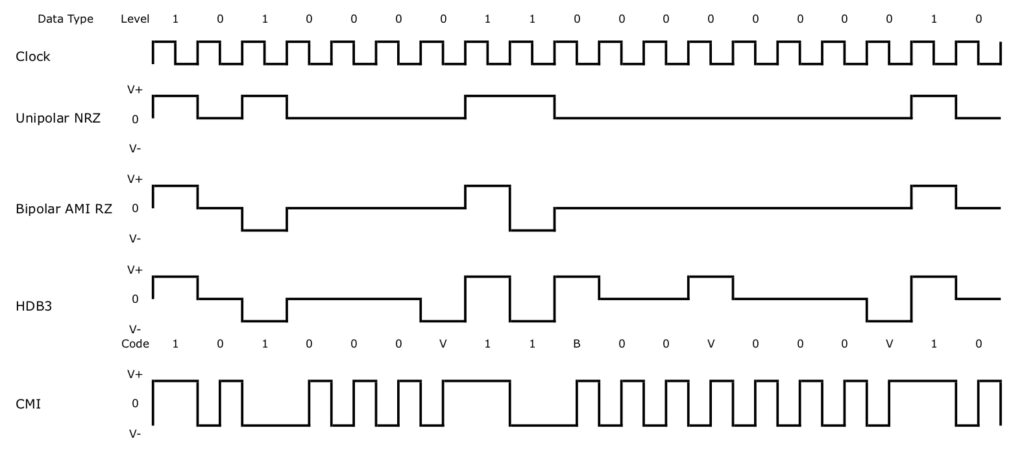

PDH Higher Order Multiplexing

By the late 1970s, the UK had adopted the ITU-T recommended PDH (Plesiochronous Digital Hierarchy) of E-carrier higher-order multiplexing at 8Mbit/s, 34Mbit/s (in the US, T-carrier at 6Mbit/s, 45Mbit/s) and 140Mbit/s.

The lower rates of the E-carrier system adopted HDB3 coding, which replaces 4 ‘0’s with ‘000V’ or ‘B00V’ (or in the US for T1, B8ZS coding which replaces 8 ‘0’s with ‘000VB0VB’).

CMI (Coded Mark Inversion) was included in the ITU-T standards for higher-order PDH at 140Mbit/s PCM (as well as SDH at 155Mbit/s electrical STM-1). This is a 1B2B type of NRZ coding where a ‘0’ is represented by ’01’ and a ‘1’ as an alternatively ’00’ and ’11’, with +V and -V representing the coding levels.

The advantage of the coding is it makes clock recovery by the receiver simple and for maintaining synchronisation alignment with a long sequence of ‘0’s or ‘1’s.

Optical fibre systems

From the beginning of the 1980s, early optical-fibre multi-mode systems operating at 850nm were deployed, and later single mode at 1300nm, using the PDH multiplexing capacities.

Typical of long-haul PDH optical-fibre systems, the 2 Mbit/s, 8 Mbit/s and 34 Mbit/s ‘Dynanet’ products from Nokia have ITU-T G.703 compliant digital interfaces using the HDB3 code, but using an optical transmission Line Code of 5B6B. This is another type of mB-nB code, where in this case 5 bit data words are coded using 6-digit code words

e.g. ‘00000’ being represented as ‘100111’.

As well as its use on electrical systems, CMI Line Coding has also been popular for use on short-haul optical-fibre transmission such as ’tactical’ fibre optical systems operating at 2 Mbit/s.

SDH / SONET – A different approach

For optical SDH systems, STM-1 and above, scrambling is employed instead of line codes to ensure the incoming bit stream contains sufficient transitions for maintaining synchronisation. This works by combining the data signal with a pseudo-random bit sequence generated by a scrambler polynomial generator.

i.e. with a sequence of length of 127, the generating polynomial is 1+x6+x7 , leading to input data ‘00000000001111111111’ being scrambled as ‘11111110000001000001’.

Optical PDH still serving

In most cases higher-order optical PDH has been decommissioned, but optical transmission at 2Mbit/s is still in operation for many low-data rate applications, where costly replacement with SDH, WDM or carrier Ethernet would bring no advantage. An example product is the Nokia DF2-8 which continues to offer reliable access services, particularly in the Utilities and Transportation industries.

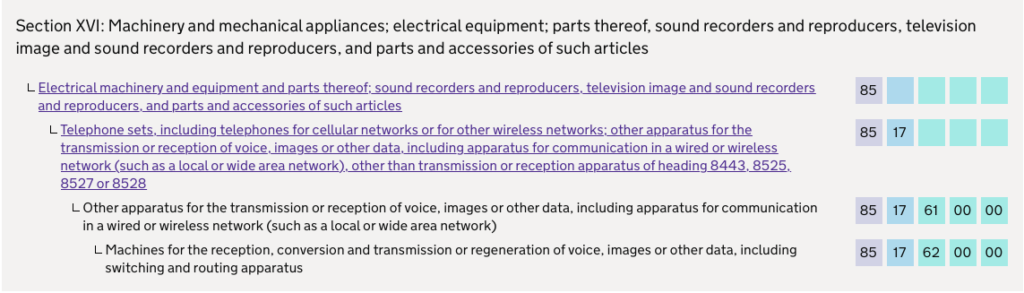

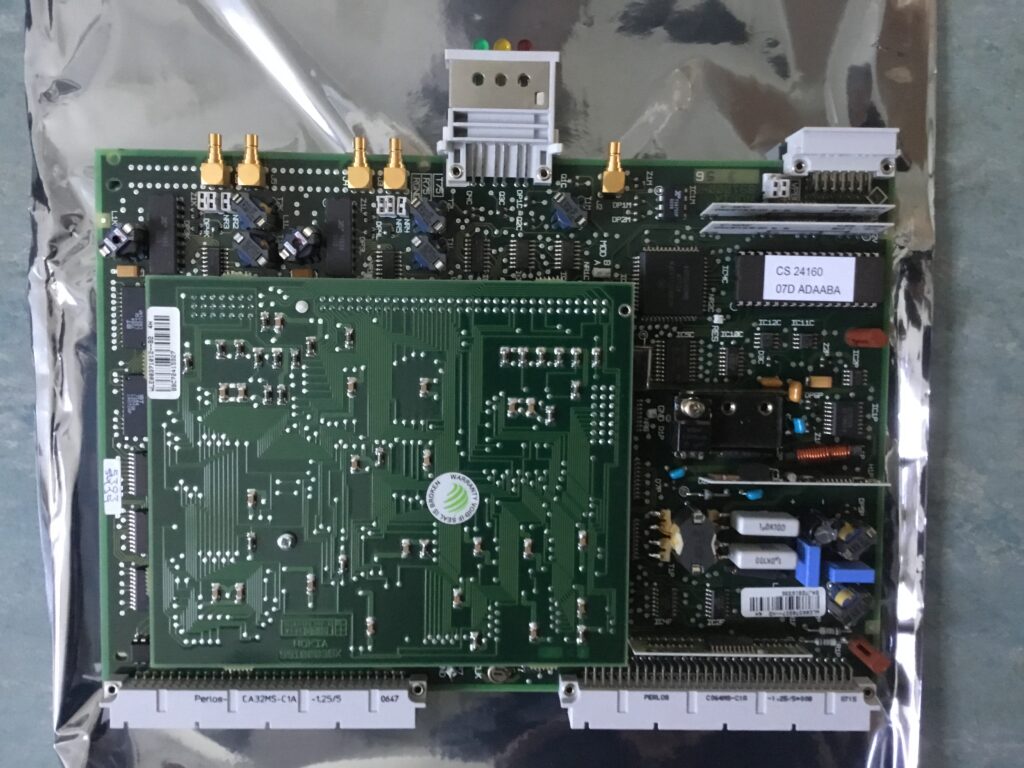

Copper systems still in operation

Though core copper electrical transmission systems have now been discontinued, much of ‘last mile’ telephony and related broadband connections are still copper access. For extended data transmission applications, copper systems are still deployed and maintained. Such products include the Nokia DSL2i copper line equipment (including power feeding repeaters) using SHDSL (Single-pair High-speed Digital Subscriber Line). This uses TC-PAM (Trellis-Coded Pulse-Amplitude Modulation) which is a 4B1H Line Coding, since translates 4 binary digits into 1 Hexadecimal (16) levels. It improves range, especially when used with regenerative repeaters, and improved ADSL (Asymmetric Digital Subscriber Line) compatibility.

Feedback and assistance

This has been a necessarily very brief run-through of legacy transmission and some of the Line Codes employed. @YellowsBestLtd would be keen to hear your experiences and knowledge of transmission systems and performance of Line Codes. If we can be of any assistance with your solution requirements, including both new and legacy technologies, then please get in touch.