New rules for Business

It’s been an uncertain period leading up to the United Kingdom (UK) leaving the European Union (EU). Now that that ‘Brexit’ has happened, as of 1st January 2021, businesses are having to work out the practical changes having an impact on international trading.

The reality of the situation is that it will take time to fully understand the new rules and what effect they have on imports and exports. Due to this uncertainty, some companies are choosing to curtail international activities, which is having an effect on availability of supply.

So this is a subject that will need to be revisited as experience is gained. What seems likely is that there will be more administration and higher costs.

@YellowsBestLtd has a 5-year history of trading not just within the EU, but globally, and it’s this experience which is helpful in understanding the adjustments needed. Put simply, all import and export business within and beyond the EU is now ‘similar’ in principle in terms of customs and tax, with or without government ‘trade deals’ being agreed.

VAT charging and reclaim in the UK

It’s helpful to first understand how VAT works on a national level. In the UK, it’s charged on the sale of many goods where ‘value has been added’ at a rate of 20% of the selling price. To consumers, that’s just a tax they pay within the total purchase price. For businesses, that element of the sale is ‘collected’ on behalf of the government, totaled and paid quarterly via their tax return. However, VAT-registered businesses are able to ‘claim back’ the taxed paid on their own purchases. The logic being, that when you’re ‘trading’ i.e. buying and selling, the amount of tax due on goods is that relating to the ‘value add’ – so the difference between the tax charged on the cost price and that charged on the selling price. Which of course should be more, if you’re making any kind of profit.

How VAT previously applied for UK businesses trading within the EU

To avoid the complications of how to ‘settle’ the collection and claiming back of taxes on purchases made between EU member states, an arrangement is in place such that each country is responsible for their own VAT affairs. Here’s how charging for VAT works for businesses when trading within the EU:

- The goods are zero-rated for VAT, from suppliers that are VAT-registered. This means that the export invoice, stating “intra-community supply”, charges VAT at 0%.

- The VAT-registered buyer (importing company) then declares the ‘acquisition’ on their VAT return (in “Box 2”)

- The buyer simultaneously also ‘reclaims’ the VAT (included in “Box 4”) on the same VAT return

- The logic behind these transactions is that the purchaser acts as both the “seller and the buyer”, for VAT purposes, Hence the transaction is accounted for entirely within one member state, and no funds need to be transferred to or from the tax authorities.

When these arrangements applied to UK businesses selling goods to buyers in EU member states, a ‘VAT EC Sales List” also needed to be completed and sent to the HMRC.

VAT and trading globally

Now the UK is ‘outside’ the EU, the ‘intra-community’ arrangement for VAT no longer applies from 1st January 2021. Instead, all international trading follows the same process, for all countries both within and beyond the EU.

UK businesses making global purchases receive an invoice from their international supplier which has no VAT added. But the UK government will separately charge VAT at 20%; this amount needs sending directly to HMRC. Typically, this amount will be collected by the courier physically transporting the goods, and normally an administration fee will be additionally charged for this transaction. If an agreement hasn’t been made with the seller, it is often the case the buyers find they need to pay these additional costs before the imported goods will be released from customs and delivered. Reclaiming of import VAT will then be made via the VAT return as an input tax, following the normal rules for UK-paid VAT.

Alternatively, import VAT can be accounted for using “postponed VAT accounting” on the VAT-return, which essentially is a similar scheme to the EU “intra-community” arrangement. This requires ensuring that the courier is advised how import VAT will be accounted, so they can complete the customs declaration appropriately.

Similarly, UK businesses selling goods internationally don’t add VAT to their invoices, but are likely to have import taxes added by the authorities in the receiving country. If the buyer has not agreed to include these additional costs within their purchase order, this can mean that the seller needs to settle these charges as part of their cost of supply, typically being charged by the courier used to deliver the goods. The difficulty is knowing in advance what is likely to be charged.

Customs Duty and Commodity Codes

In addition to VAT, businesses trading internationally need to take into account Customs Duty (and for certain products, Excise Duty as well) that may be charged on imports.

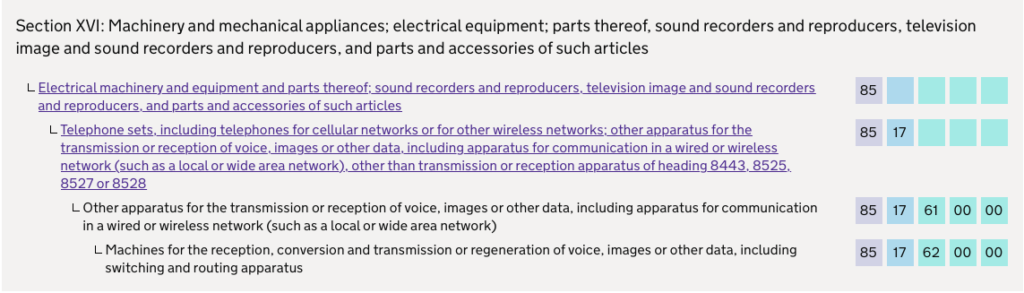

For UK businesses, this means checking with the HMRC and specifying the correct ‘Commodity Code’ for the goods, which will determine how much is charged. Unfortunately, there are thousands of such codes, covering all manner of products, so identifying the right code can take some searching.

@YellowsBestLtd typically imports a range of telecommunications spare parts, and can therefore advise that for similar requirements the following is applicable: Commodity Code: 8517620000

According to the HMRC website, sales of these goods should have no Duty to pay on imports. It’s less clear what may need to be paid on exports since this will vary by country. The ongoing concern is trying to anticipate these costs in advance, but by making an excessive allowance for them can mean an uncompetitive offer, causing a loss of business.

Your Experiences and Questions

We’d like to hear about your concerns or practical experiences of international trading, both before and after Brexit, within and beyond the EU. Please get in touch, and let us know how we can help with your continuing business requirements. We look forward to hearing from you.